Report Found States Net More Than $3.7 Billion from Recreational Marijuana Tax in 2021

Report Found States Net More Than $3.7 Billion from Recreational Marijuana Tax in 2021

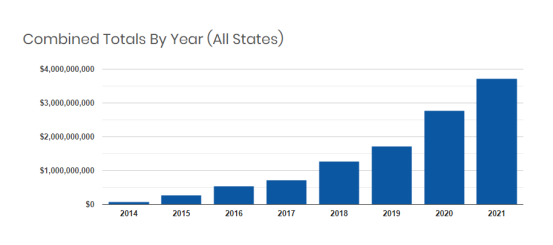

A new MPP report shows that states that have legalized marijuana use generated more than $3.7 billion in recreational cannabis sales tax in 2021.

This combined tax windfall is a 34% increase compared to 2020 combined cannabis tax revenues of 2.76 billion.

The report by MPP is based on total adult-use cannabis tax revenue collected by each legal state since 2014 when Colorado and Washington State first legalized recreational use.

To date, eighteen states have laws that legalize, tax, and regulate cannabis for adults 21 and older. Eight of those states only approved the laws in the past couple of years, while six have yet to start sales and tax collections.

The figures don't include the taxes implemented by local cities or towns. Nor do they include the vast sums from medical cannabis tax revenue, license and application fees paid by cannabis businesses or taxes generated from the workers in the cannabis industry, or corporate taxes paid to the federal government.

It is clear that the legalization and regulation of cannabis have generated billions of dollars in tax revenue and helped create many thousands of jobs across the country.

In stark contrast, states that lag behind when it comes to legalizing cannabis for recreational use are missing out on millions of dollars in lost revenue. Many of which are still enforcing archaic cannabis laws, which cause more harm than good and waste valuable resources.

Here are the breakdowns of the 2021 recreational cannabis tax revenue by state and population to help put it in perspective.

Pop 730,000 Alaska: $28,900,231

Pop. 7.3 million Arizona: $153,824,757

Pop. 39.5 million California: $1,294,632,799

Pop 5.8 million Colorado: $396,157,005

Pop 12.7 million Illinois: $424,206,703

Pop 1.3 million Maine: $12,362,622

Pop. 6.9 million Massachusetts: $227,474,842

Pop 10 million Michigan: $209,912,278

Pop. 3.1 million Nevada: $159,885,501

Pop 4.2 million. Oregon: $177,773,944

Pop 7.6 million. Washington: $630,863,570

Here are the total revenues from each state since they legalized recreational marijuana use.

Oct. 2016 to End 2021 Alaska: $102,274,177

2021 to Jan. 2022 Arizona: $169,153,405

2018 to End 2021 California: $3,440,801,614

2014 to Feb. 2022 Colorado: $1,819,517,031

2020 to Feb. 2022 Illinois: $679,487,694

Oct. 2020 to Feb. 2022 Maine: $16,437,036

Nov. 2018 to Feb. 2022 Massachusetts: $444,381,123

Dec. 2019 to Feb. 2022 Michigan: $333,289,620

July 2017 to End 2021 Nevada: $508,287,750

Feb. 2016 to End 2021 Oregon: $177,773,944

June 2014 to End 2021 Washington: $3,041,947,860

To see more about the tax rates, what states spend those taxes on, and how tax revenue is helping states see the full report at mpp.org