Cannabis Industry Statistics 2024

Cannabis Industry Statistics and Insights for 2024

How is the cannabis industry performing, and where is it heading?

The only constant for the cannabis industry is change. Marijuana regulations, laws, sentiment, technology, and business practices change yearly, meaning there's a long list of new data and insights to unravel.

To paint a clear picture of the state of the cannabis industry, we scoured the Internet for the most relevant and essential cannabis statistics for 2024.

In this report, you'll find marijuana use statistics, national sentiment around weed acceptance/accessibility, marijuana market growth, employment trends, and legal facts.

These are the key findings:

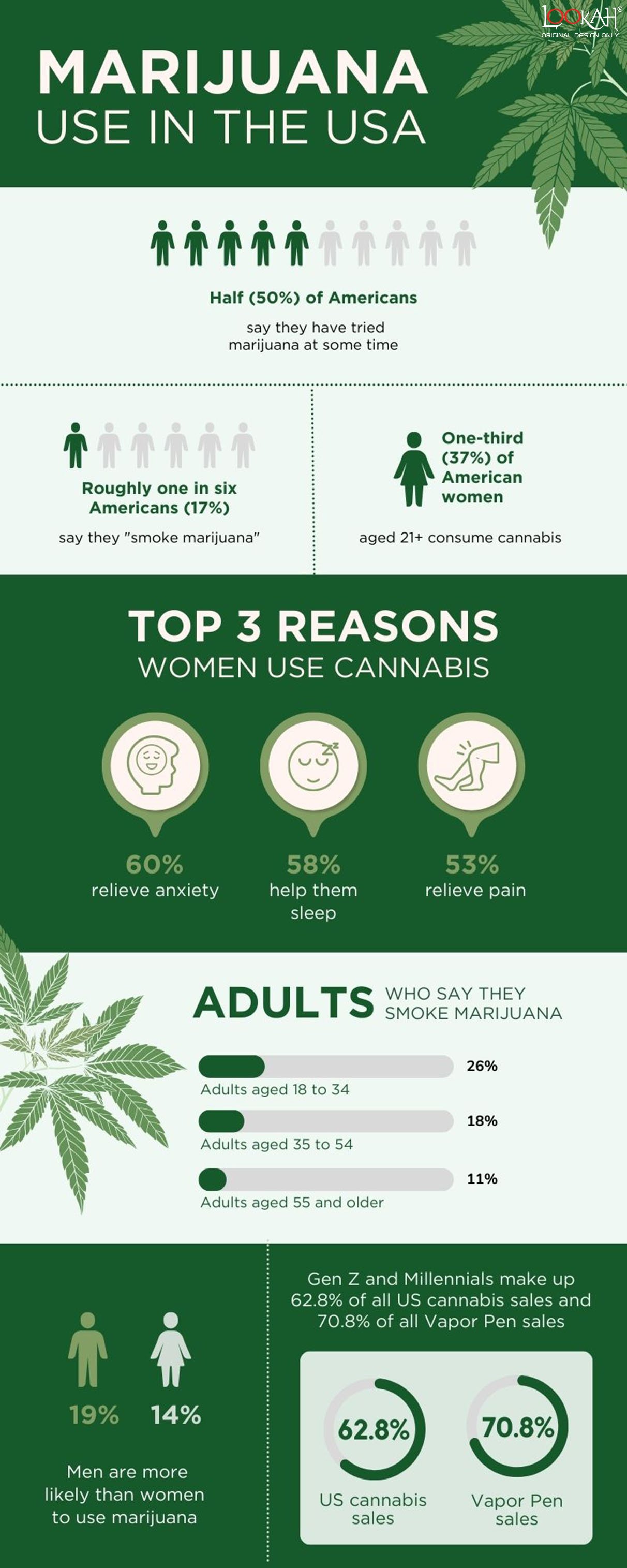

- 50% of Americans have tried marijuana.

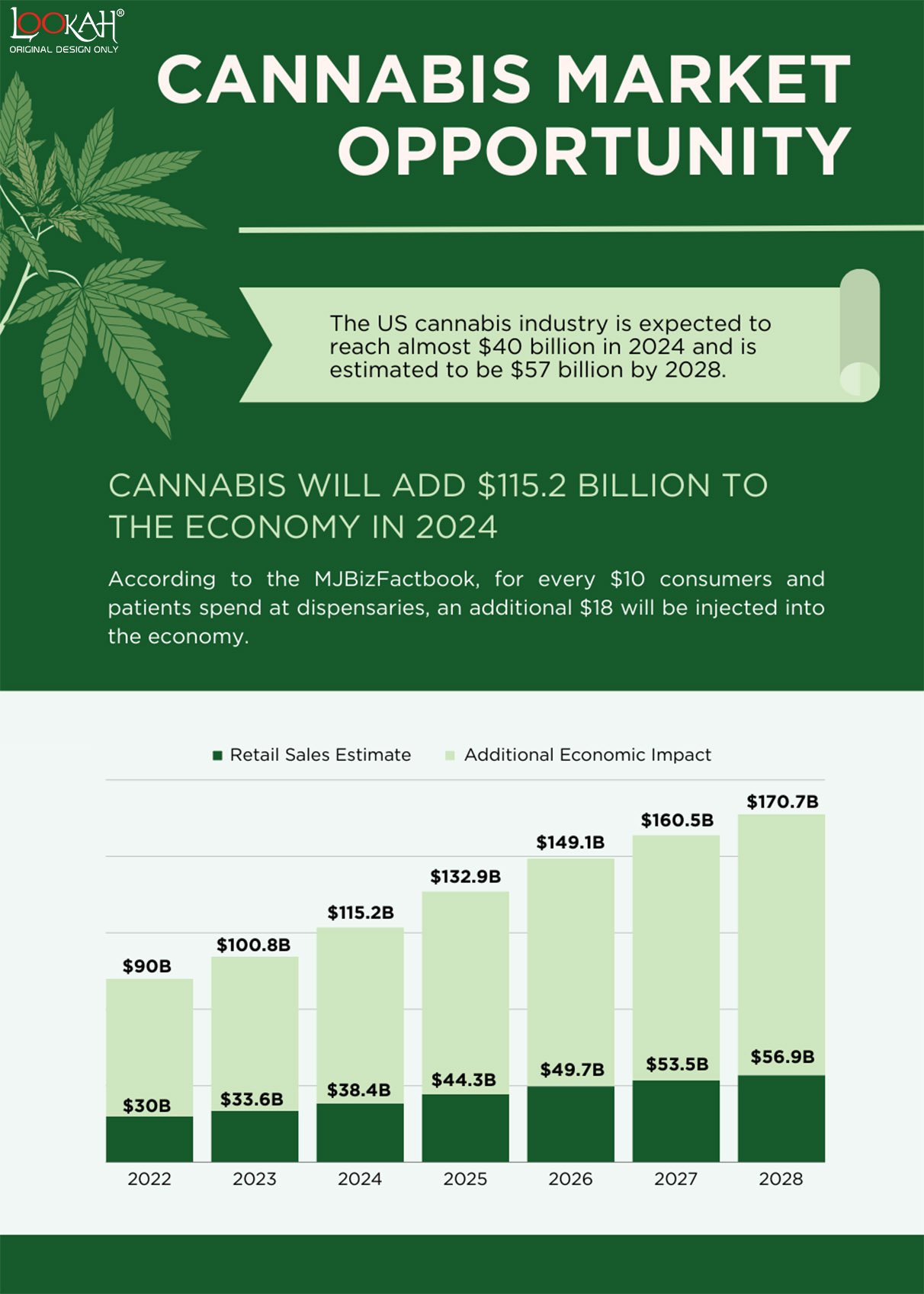

- The U.S. cannabis industry will grow to $40 billion in 2024.

- One-third of women over the age of 21 use marijuana.

- In 2024, marijuana will add $115.2 billion to the economy.

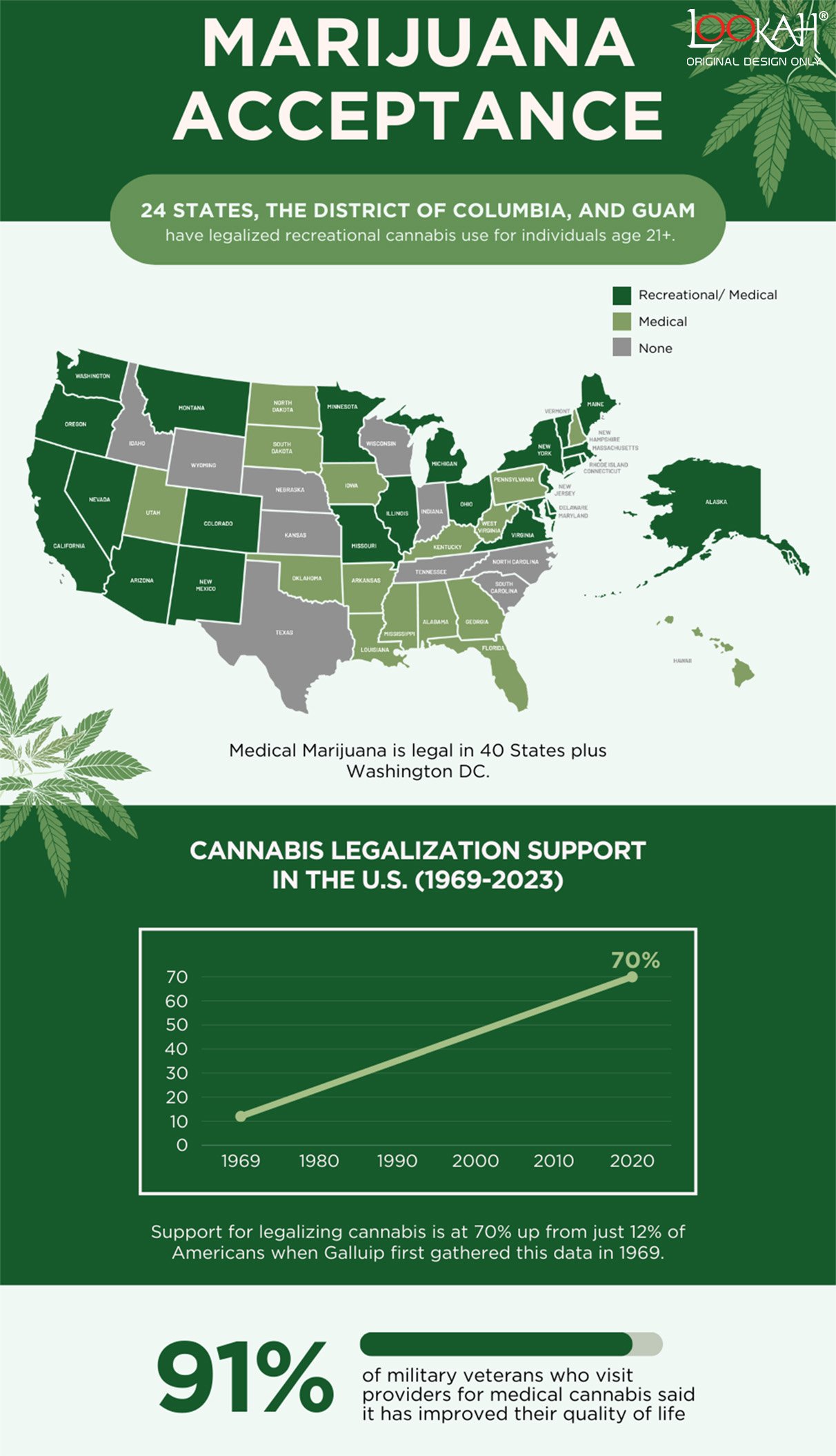

- Adult marijuana use is now legal in 24 states.

- Support for legalizing marijuana is at a record 70 percent.

- Female and minority cannabis executives are climbing back up the ranks.

- In nine states, marijuana generates more tax revenue than alcohol.

- Since 2021, the average retail price of cannabis has decreased by 32%.

- Dispensaries that accept debit cards make an average of $4,627 more than retailers that only accept cash.

Cannabis use statistics -- Nearly half of Americans have tried marijuana

According to a Gallup poll, 50 percent of Americans say they've tried marijuana at some point, a new high.

In response to another question, about one in six Americans (17 percent) said they "smoke marijuana." This is also a new high since Gallup started doing these yearly polls.

In 1970, the number of Americans who responded saying they had tried marijuana was around 6%. This figure increased steadily through the 70s and early 80s but remained in the low to mid 30% range from the early 80s until the mid-2000s. It only went above 40% around 2012.

One-third of women over the age of 21 use marijuana

A recent study for MedMen conducted by The Harris Poll found that more than a third (37%) of American women over the age of 21 smoked marijuana.

The national survey also found that women use cannabis primarily for therapeutic reasons. The top three reasons women use marijuana are to relieve anxiety (60%), help sleep (58%) and relieve pain (53%).

Many female cannabis consumers do so in private. The study found that 65 percent of women who use marijuana say there are people in their lives who still don't know they are using marijuana, including parents, children, and co-workers.

Pre-rolls are taking off

Pre-rolls are the third largest product category in the United States, after flower and vape pens.

The popularity of pre-rolls has exploded since the beginning of 2022.

A Headset report comparing the first eight months of 2023 to the previous year found that U.S. pre-roll sales were up 13.4 percent. This significantly outpaces other categories, such as concentrate and edibles.

Pre-rolls are also making up a larger share of total dispensary sales.

In the United States, pre-rolls accounted for 15.3 percent of total sales, up 32 percent from 11.6 percent in January 2022.

Younger consumers prefer cannabis vape pens

According to Headset, Gen Z and millennials together account for 62.8 percent of U.S. marijuana sales and 70.8 percent of Vape Pen sales.

Gen Z were big adopters of nicotine vaporizers, which has influenced the way they consume cannabis. This preference is probably due to their familiarity with vapes since we see a gradual decrease in preference for vape pens with increasing age.

21 percent of Dry January participants are replacing alcohol with marijuana and CBD

A recent survey by CivicScience found that 21 percent of people who quit drinking for Dry January (a popular trend to abstain from alcohol for a month) are replacing alcohol with marijuana or CBD.

The same survey also found that the largest age group for replacing alcohol with marijuana was 21-24 years old (34%), followed by 25-34 years old (24%).

Since the pandemic, we've seen an increase in young people replacing alcohol with marijuana. These Dry January statistics confirm the hypothesis that more and more of the younger generation is turning away from alcohol and using marijuana as an alternative.

Marijuana acceptance in the United States

Recreational marijuana is legal in 24 states

As of January 2024, 24 states, the District of Columbia, and Guam have legalized recreational marijuana use for individuals over the age of 21: Alaska, Arizona, California, Colorado, Connecticut, Delaware, Illinois, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Montana, Nevada, New Jersey, New Mexico, New York, Ohio, Oregon, Rhode Island, Vermont, Virginia Virginia and Washington.

Delaware, Minnesota, and Ohio were added to the list of states where adult recreational marijuana use is legal in 2023.

Medical marijuana is now legal in 40 states

The medical use of marijuana is now legal in 40 states plus Washington, DC: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Hawaii, Illinois, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Utah, Vermont, Virginia, Washington and West Virginia.

Kentucky was added to the list of states where medical marijuana is legal in 2023.

Support for legalizing cannabis is at an all-time high of 70%

According to a recent Gallup poll, 70% of Americans believe cannabis should be legal, the highest level since Gallup started recording this figure 45 years ago.

In 1969, when Gallup first collected this data, only 12 percent of Americans supported legal marijuana.

Medical marijuana improves life quality for veterans

A recent study published in Clinical Therapeutics found that 91 percent of veterans who visited medical marijuana providers said marijuana improved their quality of life.

The use of medicinal cannabis by many study participants was reported to improve quality of life and reduce unnecessary drug use. The current findings suggest that medicinal marijuana can play a harm-reducing role, helping veterans reduce their use of pharmaceutical medications and other substances.

As cannabis use has become more widely accepted, its positive health effects and public health benefits have become more widespread. For veterans suffering from post-traumatic stress disorder, substance abuse, illicit drug use, and other issues, the cannabis plant has become a supplement to traditional health care and prescription drugs.

Cannabis market opportunity

According to Statista's forecast, total cannabis revenue is expected to reach $39.85 billion in 2024.

Statista also expects the marijuana market to reach more than $67 billion in revenue by 2028 as the legalization movement around marijuana grows.

Cannabis will add $115.2 billion to the economy in 2024

According to MJBizFactbook, every $10 spent by consumers and patients at pharmacies pumps an additional $18 into the economy.

Much of this economic stimulus has occurred at the local level, boosting growth in areas where cannabis products are sold.

Marijuana generates more tax revenue than alcohol

Cannabis is often compared to the alcohol industry, although the two are fundamentally different.

Not only does marijuana seem to be better at avoiding hangovers, but it also brings in more tax revenue for states.

The Tax Foundation found the following problems with marijuana and alcohol taxes:

"The largest and oldest markets generate the most [marijuana tax] revenue in California, Washington, and Colorado." In the first quarter of 2023, 10 states - Arizona, Colorado, Maine, Massachusetts, Michigan, Montana, Nevada, New Mexico, Oregon, and Washington - received more revenue from marijuana than from alcohol (nine states) or tobacco (Washington)."

In nine states, marijuana brings in more tax revenue than alcohol, and that number is only expected to increase.

Prices are still being squeezed, and brands are consolidating

The trend of competitive pricing between cannabis brands and retailers has led to a sharp drop in prices starting in 2021. While there are signs that this compression is slowing and even rising in some states, it's important to track this compression.

The BDSA Retail sales tracker found that the equivalent average retail price (EQ ARP) declined by -32% (from its peak in Q3 2021 to Q2 2023). Falling prices, coupled with inflation (which increases labor and material costs for licensees), have made the industry more competitive.

Compressed prices affect cannabis brands and retailers, squeezing profit margins and forcing dispensaries to grapple with the effects of compressed cannabis prices.

For the THC brand, price compression has led to considerable consolidation. Across all markets tracked by the BDSA, the share of total sales accounted for by the five top-selling brands increased by 14% between the second quarter of 2021 and the second quarter of 2023.

Similarly, about 25 percent of the 50 best-selling flower varieties in California and Colorado come from the same brand. This shows how competitive (and compressed) the brand landscape is becoming.

Female and minority cannabis executives are climbing back up the ranks

The latest data from the MJBiz Diversity, Inclusion, and Equity report found that women make up 39 percent of cannabis executives, compared to 24 percent from minorities. That's a big jump from last year's 23 percent for women and 12 percent for minorities.

The cause of the jump is still unknown. "Diversity is returning to the C-suite for reasons that have yet to be determined," explained Andrew Long of MjBizDaily.

While the Cannabis Social Equity Initiative has been criticized in the past for failing to meet its goals, it appears to be supporting marginalized groups in the industry.

Cannabis market Trends

Cashless payment improves pharmacy performance

Flowhub's data from Green Wednesday 2023 found that pharmacies that accept debit cards make an average of $4,627 more per day than retailers that only accept cash.

In addition, pharmacies that offered debit card payments processed 59 percent more transactions compared to cash-only pharmacies, and transactions that used debit cards were $13 higher than those that used cash only.

Although the cannabis industry has historically been a cash-based industry, cannabis consumers still want to pay with cards.

We see this trend accelerating in all other industries as well. McKinsey's Global Payments 2023 report found that global cash use fell by nearly four percentage points in 2022.

Continued adoption and growth of cannabis debit payments are expected in 2024.

In the United States, millennials account for nearly half of marijuana consumption

Headset's demographic report states that millennials are the largest group of cannabis consumers, accounting for 46.2% of cannabis consumption.

However, Gen Z is the fastest-growing group of cannabis users and is rapidly eating into the dominant market share of millennials. Compared to the same period last year, the percentage of total marijuana sales accounted for by these young people increased by 11.3 percent.

SMBs are the engine of cannabis M&A economy

Following the explosive early success of the industry, the contraction of the cannabis industry has led to a restructuring of the industry.

Laura A. Bianchi, founding partner of Bianchi & Brandt, explained the situation in A recent trend report, noting: "We've been in a highly active cannabis M&A environment for years, and we've been in a highly active cannabis M&A environment in the wake of massive, unexpected pandemics and the ones that followed. The collapse of the marijuana market from coast to coast - we're in the midst of a big correction right now."

Instead of large acquisitions and rapid multi-state expansion, we see small and medium-sized businesses (SMBS) now being the focus of most M&A activity.

Laura continued in the Trend Report, "Savvy businesses are looking for mutually beneficial partnerships that will allow them to get a foothold in the market to weather this correction. Many smaller cannabis businesses are merging in order to survive. Some are finding that their new partnerships are helping them thrive in these conditions. Others enter into bad partnerships out of desperation, and we may well see them in court in the future."

The increase in cannabis sales varies according to the age of the market

MJBizDaily recently found that the year-over-year growth rate of the cannabis market varies depending on the age of each market.

In new markets such as Arizona, Illinois, and Maine, sales continued to grow but at a slower rate than in 2022. For these states, economic growth is likely to slow.

At the same time, mature markets such as Colorado and Nevada did not decline as much as in 2022. For these states, it's a promising sign for 2024.

Cannabis shoppers do research online before making a purchase

A recent data survey by BDSA explored the actions pharmacy shoppers take before making a purchase. The report found that people who buy marijuana regularly are more likely to prepare for a purchase through online research.

Forty-two percent of pharmacy regulars report going online to check a particular pharmacy's menu. This "frequent shopper" group is also more likely to seek out deals and promotions (30 percent of weekly shoppers versus 17 percent of monthly shoppers).

The BDSA report also shows that buying plans vary depending on how much consumers spend. Shoppers who are in the top 25% of spending per visit do more online research before replenishing (42% report checking pharmacy menus).

By 2024, easily accessible pharmacy websites will become increasingly important. Retailers can rely on these "researcher-first buyers" groups by optimizing product pages to rank higher on Google.

Cannabis employment demand

Cannabis employment declines in 2023

The 2023 Vangst Employment Report found that legal cannabis supported 417,493 full-time equivalent jobs as of early 2023. That's down 2 percent from a year ago, and it's the first decline in the number of jobs in the history of legal marijuana.

Vangst said the reasons for this decline are largely attributed to economic headwinds such as limited capital investment, inflation, and slower-than-expected legal action. This period is considered an industry-wide reset that is unlikely to extend beyond 2024.

The employment picture is not entirely bleak. Fenster pointed to double-digit income growth and job creation in emerging markets such as Michigan, New Jersey, Illinois, Missouri, Montana, and New Mexico.

Major states have great potential for job growth

Markets such as California, New York, New Jersey, and Virginia have yet to realize the full potential of their respective cannabis industries. California, for example, offers only about 83,000 marijuana jobs compared to 133,000 potential jobs.

Vangst explains in its employment report, "If state policymakers work together to shift traditional market consumers to legitimate, licensed, tax-paying stores, we should see double-digit job growth."

In 2024, the industry is expected to be back on track in terms of revenue and job growth.

Cannabis law update

After legalizing adult marijuana use in three states in 2023, five more states plan to put marijuana legislation on the ballot this year.

According to Marijuana Moment, Florida, Hawaii, New Hampshire, Pennsylvania, and South Dakota have a chance to legalize marijuana for adults this year.

Legalizing medical marijuana could move forward in four states

By 2024, the list of states with no legal marijuana at all could get shorter and shorter. Nebraska, North Carolina, South Carolina, and Wisconsin are all moving toward marijuana reform.

We hope to see more states join the list of legal marketplaces because more consumers and patients will have access to safe, legal marijuana."

2024 lays the groundwork for historic marijuana reform

In this election year, marijuana is having a major impact. The 2024 decision could be the biggest overhaul of federal marijuana policy in the past 40 years.

Here's a timeline of the big moments that could affect marijuana this year:

- October 6, 2022 - President Joe Biden releases a statement saying, "No one should go to jail solely for using or possessing marijuana." He went on to say that he would pardon all previous crimes for simple possession of marijuana at the federal level and urged all state governments. Follow suit. The president also mentioned that he would review Schedule I designations for marijuana.

- August 29, 2023 - A letter from the U.S. Department of Health and Human Services to Drug Enforcement Administration (DEA) Anne Milgram is leaked to Bloomberg. The letter calls for reclassifying marijuana as a Schedule III drug under the Controlled Substances Act.

- September 13, 2023 - A Congressional Research Service (CRS) report finds that the DEA will "likely" reschedule marijuana use because they are unlikely to go against HHS recommendations.

- December 22, 2023 - President Biden issues a proclamation granting further pardons to individuals with certain marijuana-related convictions under federal law and granting clemency to 11 individuals who the president said were serving long prison sentences for nonviolent drug offenses.

- January 4, 2024 - The DEA confirms it is reviewing marijuana rescheduling proposals.

- January 12, 2024 - The U.S. government releases documents related to its ongoing review of the status of marijuana under federal law. The documents are the first official confirmation that health officials advised the DEA to reschedule marijuana and the first official confirmation that health officials advised the Drug Enforcement Administration (DEA) to list marijuana on Schedule III of the Controlled Substances Act (CSA).

For now, we can only wait and see what the DEA decides. But one thing is for sure: marijuana policy reform will gain strong momentum in 2024.